Hydrogen is an essential component of the European and German energy transition

by Dagmar Dieterle

marketSTEEL interview with Sven Renelt, Partner at PSvdL Consulting GmbH

marketSTEEL: Mr Renelt, at PSvdL Consulting you combine expertise in the energy industry with many years of consulting experience. How do you currently view hydrogen in the context of the energy transition? What role does the steel industry play in this?

Hydrogen is an essential component of the European and German energy transition. The recently published EU report on Europe's future competitiveness emphasises this fact and identifies four urgent areas for action: increasing supply, developing infrastructure, designing regulation and financing, and cooperation among market participants.

This picture essentially coincides with the results of our cross-industry study for a successful hydrogen ramp-up in Germany, a revised version of which we published in the second quarter of this year. However, one essential criterion should be added to the list in the EU report, namely the development of a competitive price for hydrogen. This was considered to be of the highest relevance for a successful ramp-up by all eight sectors involved in our study.

This picture essentially coincides with the results of our cross-industry study for a successful hydrogen ramp-up in Germany, a revised version of which we published in the second quarter of this year. However, one essential criterion should be added to the list in the EU report, namely the development of a competitive price for hydrogen. This was considered to be of the highest relevance for a successful ramp-up by all eight sectors involved in our study.

We are currently experiencing infrastructure expansion as a key driver. The development of the hydrogen core network (Wasserstoffkernnetz) is a fundamental signal to all market participants for the next steps in the development of the hydrogen economy. In Germany, the hydrogen core network application is about to be approved and the financing framework is also in place. This means that the construction and conversion of the pipelines can begin. Our sister company, PSvdL Engineering, which supports the technical implementation of infrastructure projects is also increasingly recognizing this development.

At the same time, it is important to consider that a hydrogen network alone is of little use if it is not utilized. This requires, especially in the early stages, companies that are willing to purchase large quantities of hydrogen on a long term basis. At this point, the steel industry plays a crucial role, as it represents a significant market for hydrogen. According to forecasts, the steel industry will account for about one-third of Germany's total hydrogen demand. Moreover, hydrogen tenders by major steel companies provide electrolyser operators with the planning security they need to invest in the development and expansion of hydrogen production. This applies to producers both in Germany and abroad, as current estimates suggest that Germany will need to import 50-70% of its low-emission hydrogen requirements.

marketSTEEL: You have already mentioned that Germany is dependent on H2 imports. Where should the quantities of low-emission hydrogen come from?

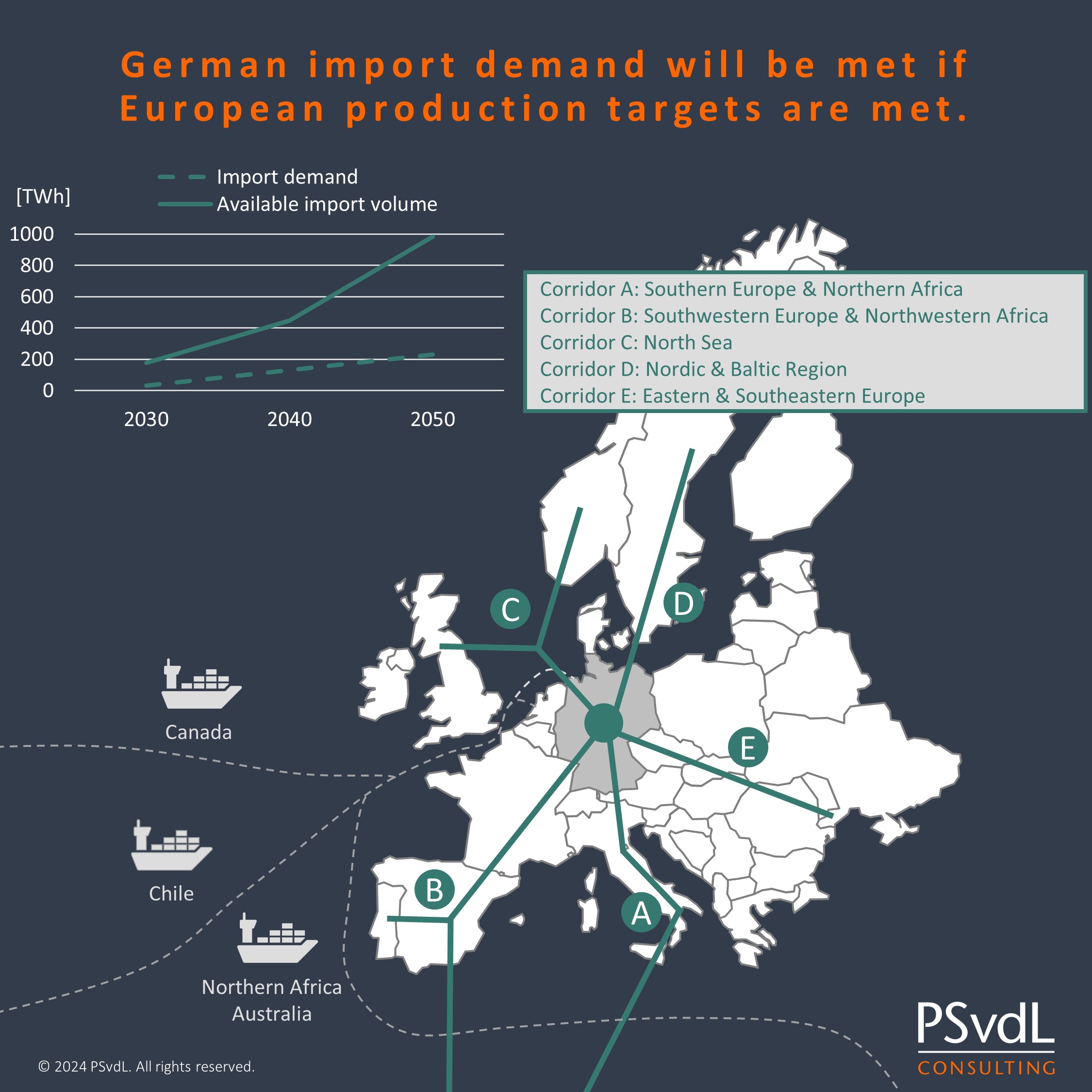

We have analysed over 40 recent studies and gained the following insights. The demand for low-emission hydrogen in Germany is expected to rise to around 420 TWh per year by 2050. As previously mentioned, the majority of this demand will have to be met through imports.

We have analysed over 40 recent studies and gained the following insights. The demand for low-emission hydrogen in Germany is expected to rise to around 420 TWh per year by 2050. As previously mentioned, the majority of this demand will have to be met through imports.

The German government aims to diversify import routes with its hydrogen import strategy. In the future, hydrogen is expected to be imported both in gaseous form via pipelines and as liquefied hydrogen or hydrogen derivatives by ship.

A European pipeline grid is currently being planned for gaseous transport. Starting in 2030, it will initially transport hydrogen from Denmark, then from Norway and southwest Europe (mainly Spain and Morocco), and finally also from southern Europe (mainly Italy and Tunisia) and eastern Europe (mainly Ukraine and Greece).

If these importing countries meet their electrolysis targets, Germany's import demand can be met. At the same time, domestic production and its funding remains essential, also in terms of minimising Germany's dependence on hydrogen imports.

marketSTEEL: In addition to the question of hydrogen supply, you mentioned a competitive hydrogen price as an essential factor for a successful hydrogen ramp-up. In view of this, have you also looked at the future price level?

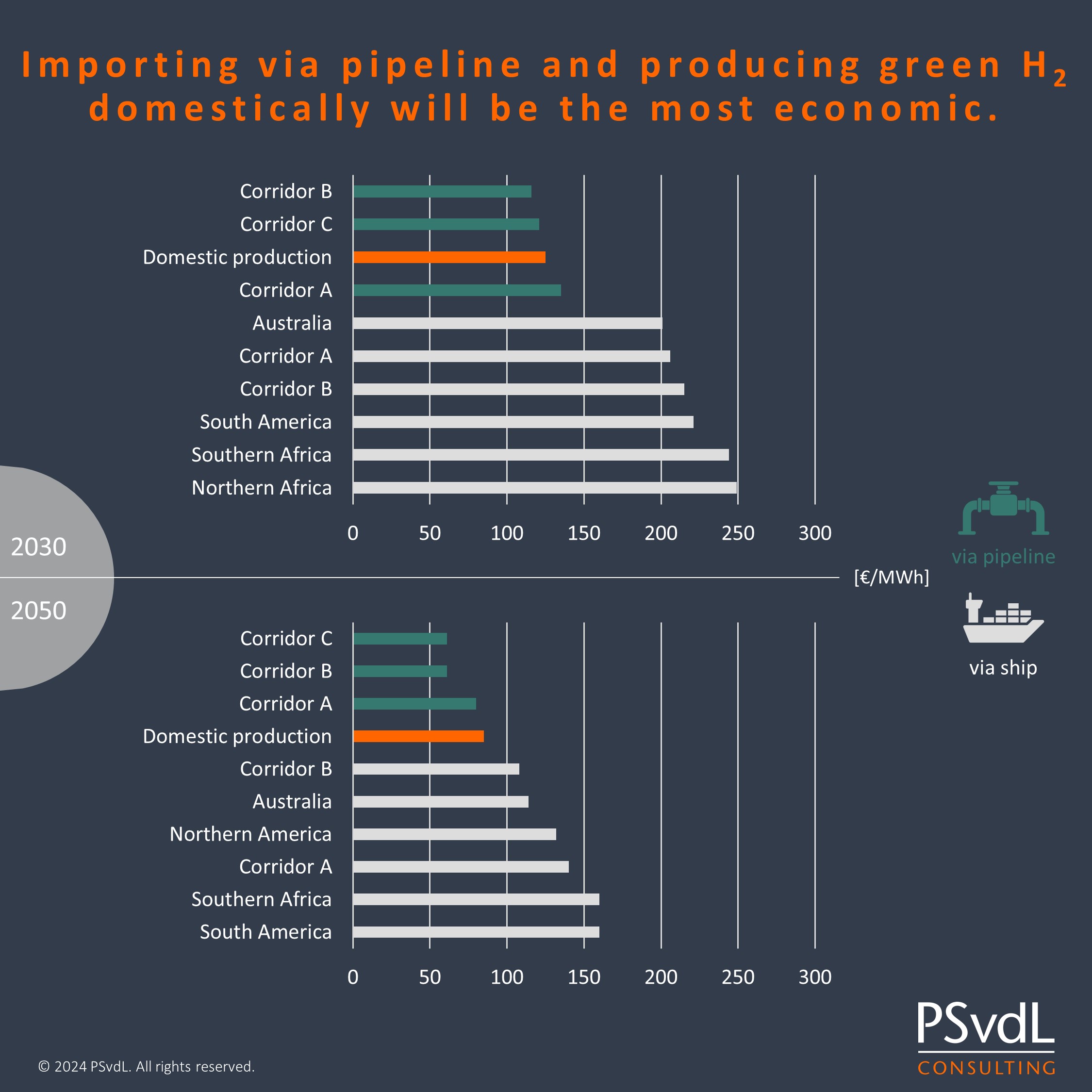

As mentioned at the outset, costs are the decisive factor for the use of hydrogen, which is why we have examined them separately over time and in comparison with foreseeable import routes. Our analysis shows that, from today's perspective, domestic production costs for green hydrogen and the average costs for pipeline imports will be at the same level, at around €125/MWh, in 2030. By 2050, import costs via pipeline are expected to fall by around 50%, slightly below the also decreasing domestic production costs. It also appears that global ship imports in 2050, averaging around €136/MWh, would represent the most expensive option.

As mentioned at the outset, costs are the decisive factor for the use of hydrogen, which is why we have examined them separately over time and in comparison with foreseeable import routes. Our analysis shows that, from today's perspective, domestic production costs for green hydrogen and the average costs for pipeline imports will be at the same level, at around €125/MWh, in 2030. By 2050, import costs via pipeline are expected to fall by around 50%, slightly below the also decreasing domestic production costs. It also appears that global ship imports in 2050, averaging around €136/MWh, would represent the most expensive option.

According to current studies, prices in 2050 would still be significantly higher than today's natural gas prices (as of October 2024: €35/MWh). However, it is important to note that new technologies and markets have often developed differently than long-term forecasts predicted, sometimes with significant impacts on prices. At the same time, European and German legislators and regulators have already demonstrated creativity in other markets to create competitive frameworks for politically desired technologies. Therefore, it is likely that we will see further support measures in the case of hydrogen to enable its supply at manageable costs.

PSvdL Consulting GmbH

PSvdL Consulting is a leading management consultancy specializing in the energy sector, with over 17 years of experience in the field. The consultancy covers all industry-specific topics along the entire value chain and supports energy providers, grid and storage operators, as well as industrial companies facing energy-related challenges.

A key focus of PSvdL Consulting is the strategic engagement with energy issues in the context of hydrogen. The sister company, PSvdL Engineering, complements this offering by addressing the technical aspects of hydrogen transformation within the framework of decarbonization transformation planning. Together, both companies provide comprehensive solutions for the challenges of the energy transition.

Read the mentioned study here: A cross-industry view of the hydrogen ramp-up in Germany - PSvdL Consulting (psvdl-consulting.com)